To help your clients’ pursuit in accomplishing their dreams, our SHEP strategies are designed to successfully navigate capital markets and ever-evolving economic conditions. Hope is not a strategy and hope alone simply will not do.

Imagine a future where you and your clients can sleep well during major market downturns, confident that SHEP is striving to prudently preserve and grow their wealth. SHEP has been uniquely designed to reduce your clients’ exposure to risks, enhance performance, and increase the possibility of converting their dreams into reality in shorter time periods.

Stone Wall Financial selects Exchange-Traded Funds (“ETFs”) it believes investors have found most trustworthy and reliable to apply our SHEP algorithmic trading strategies. In pursuit of delivering risk-adjusted performance (a.k.a. “Alpha”), as compared to buy-and-hold conventions, each ETF undergoes extensive testing, uniquely optimizing each ETF’s proprietary 63 risk thresholds and buy-back metrics.

IVV – iShares Core S&P 500 ETF

SPY – SPDR S&P 500 ETF Trust

IJJ– iShares S&P Mid-Cap 400 Value ETF

IJH – iShares Core S&P Mid-Cap ETF

IJR – iShares Core S&P Small-Cap ETF

VBK – Vanguard Small-Cap Growth Index Fund ETF Shares

QQQ – Invesco QQQ Trust

SUB – iShares Short-Term National Muni Bond ETF

TFI – SPDR Nuveen Bloomberg Municipal Bond ETF

MUB – iShares National Muni Bond ETF

LQD – iShares iBoxx $ Investment Grade Corporate Bond ETF

SPIB – SPDR Portfolio Intermediate Term Corporate Bond ETF

VCIT – Vanguard Intermediate-Term Corporate Bond Index Fund ETF Shares

VCLT – Vanguard Long-Term Corporate Bond Index Fund ETF Shares

BIL – SPDR Bloomberg 1-3 Month T-Bill ETF

SHY – iShares 1-3 Year Treasury Bond ETF

VGIT – Vanguard Intermediate-Term Treasury Index Fund ETF Shares

VGLT – Vanguard Long-Term Treasury Index Fund ETF Shares

TLT – iShares 20+ Year Treasury Bond ETF

VRP – Invesco Variable Rate Preferred ETF

JNK – SPDR Bloomberg High Yield Bond ETF

ICVT – iShares Convertible Bond ETF

GDX – VanEck Gold Miners ETF

GLD – SPDR Gold Shares

PALL – abrdn Physical Palladium Shares ETF

PPLT – abrdn Physical Platinum Shares ETF

SLV – iShares Silver Trust

USO – United States Oil Fund, LP

GBTC – Grayscale Bitcoin Trust ETF

ETHE – Grayscale Ethereum Trust

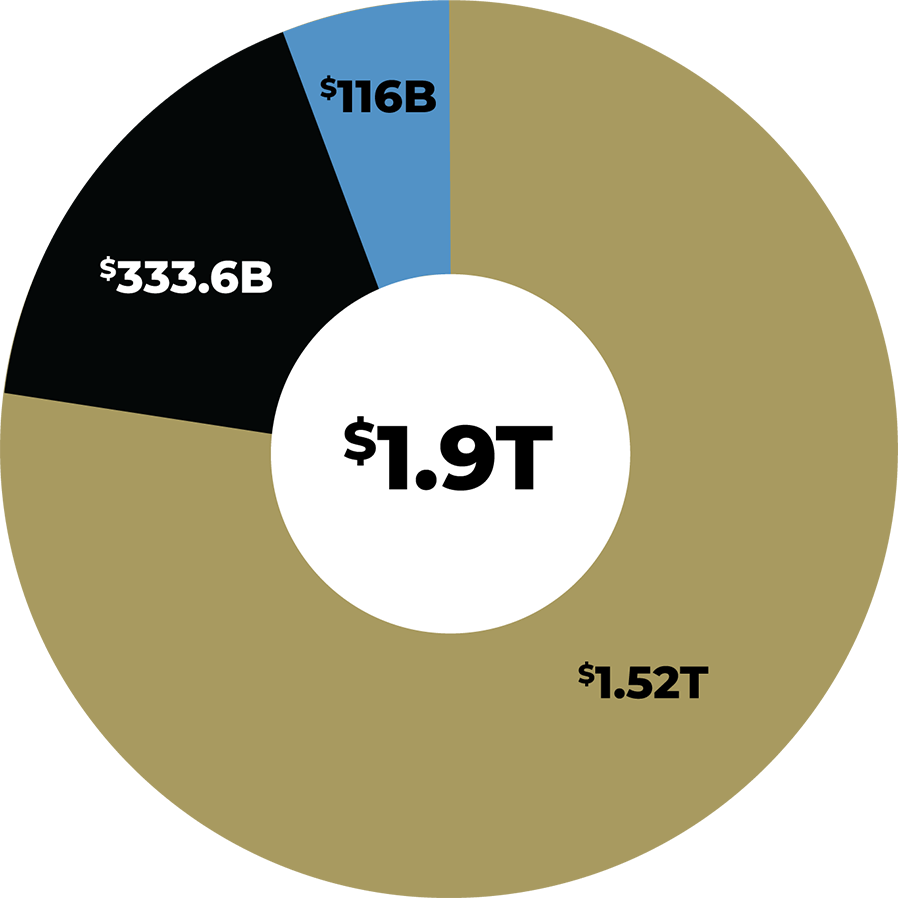

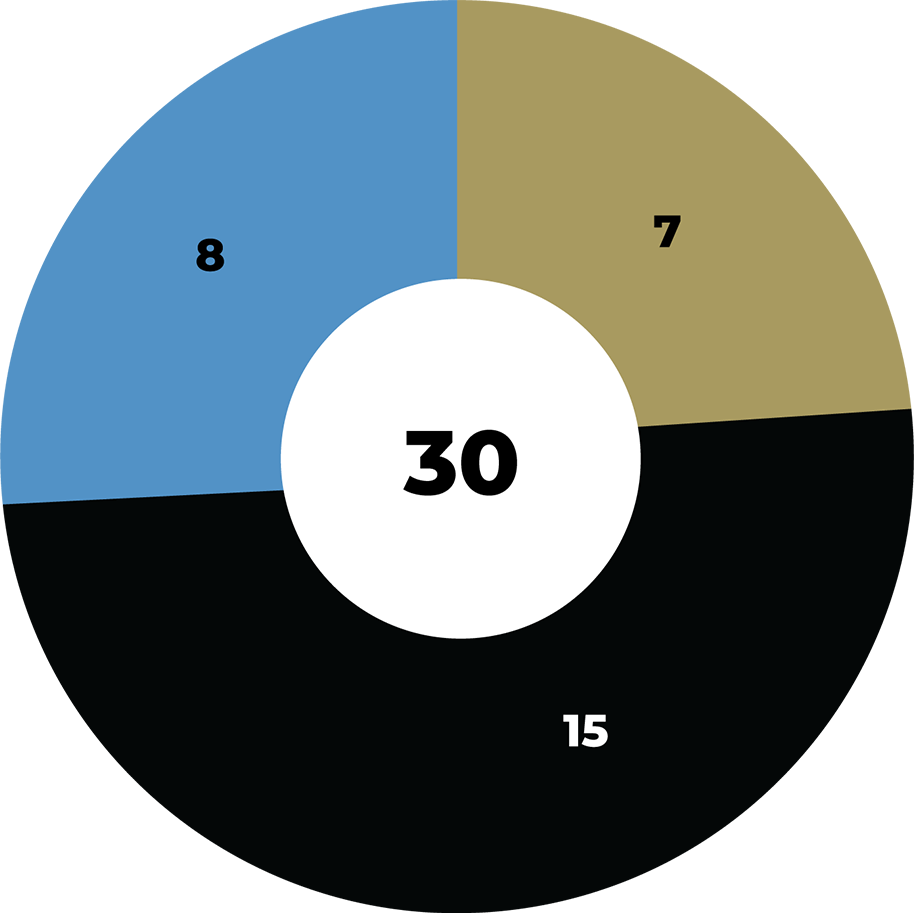

Note: The data provided here does not represent Stone Wall Financial’s AUM profile; rather, it represents the collective Net Assets investors have entrusted to the 30 ETF’s Stone Wall Financial has optimized with its proprietary SHEP strategy.

Source: Stone Wall Financial Sub-Adviser. Net Assets data from VettaFi site as of 8/15/2024 and in USD unless otherwise noted.

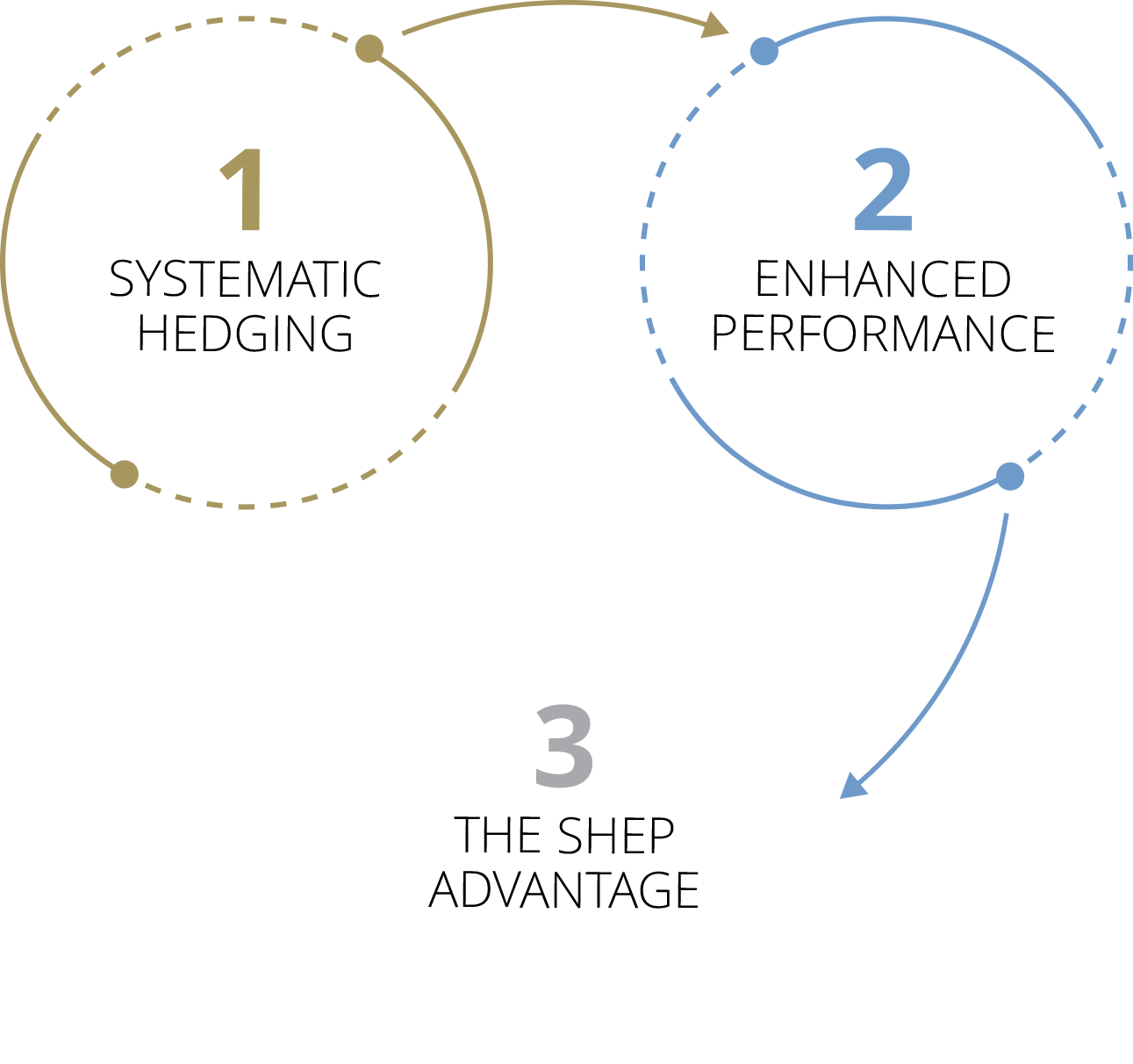

Our SHEP Advantage is produced by combining our powerful SHEP technology platform with our proprietary algorithm, the SHEP Edge. Together, investors can remain confident that the automation to enable portfolios to respond to ever-changing market environments. With each successful risk mitigation trade cycle, starting with protecting first, and then followed by successful timely reentries, investors may benefit from compounding more and more shares over time—The SHEP Advantage.

The Edge is our proprietary trading algorithm, empowered by 63 proprietary risk threshold and buy opportunity metrics, built on top of a reliable SHEP technology platform. The Edge is the key driver to all SHEP model portfolios and security investment strategies. The Edge has undergone extensive and rigorous testing as far back as 30 years across multiple securities, asset classes and investment styles. Our research and development revealed a keen ability to successfully time exit and reentry points that revealed the potential to protect in major market downturns while experiencing enhanced long-term performance.

Risk-based asset allocation constructs uniquely managed to each security’s individual optimized algorithmic metrics, resulting in more ideal tactical rebalancing

We have optimized equity strategies covering a broad range of ETFs and individual stocks, diversified by company size, investment style, and industry sectors.

Our fixed income strategies represent a wide range of core attributes necessary for diversification, including investment grade quality, sector, duration, and yield.

Alternative strategies afford our clients the ability to invest in assets that fall outside of conventional categories, optimizing commodity and cryptocurrency ETFs.

We will continue to explore how SHEP can deliver differentiated management to a variety of security types, assisting asset managers looking to boost their investment performance.

Stone Wall Financial partners with firms, their investment advisers, institutions, registered and exempt investment companies as Sub-Adviser for delivering active portfolio management and investment strategies. We champion a broad spectrum of SHEP optimized securities through a variety of offerings and distribution channels, partnering with TAMPs and ETF providers to deliver our solutions.

We provide access to diversified models consisting of popular ETFs, built to help meet the unique risk profiles, time horizon, and objectives of your clients.

Explore, by portfolio or by individual securities, how SHEP Edge may help to bolster the risk-adjusted returns of your own strategies.

As a Sub-Adviser to registered and exempt investment companies, we plan to release additional SHEP ETFs on the global exchanges.

Have your own ETF, or interested in starting one? Explore how augmenting your own strategy with SHEP Edge may help you increase alpha and lower beta.

Stone Wall Financial continues to grow a meaningful network of partners and other resources capable of contributing to our development and delivery of SHEP solutions.

Our Stone Wall Financial team has accumulated several decades of experience in risk management, regulatory compliance, technology, private wealth management, private banking, investment strategy, securities analysis, and data & analytics.

President, CEO

Managing Principal, COO

Partner, Market Strategy

Chief Compliance Officer

Partner, General Counsel

Senior Data Analyst

Additionally, we have assembled a dynamic team of talented and innovative experts in their respective fields, spanning across regulatory compliance, technology, data science & analytics, artificial intelligence, and marketing. As resources, their collective insight and precision has been a key enabler to SHEP’s product development journey and our adoption of evolving technology in pursuit of delivering best-in-class risk-adjusted returns.

Digital Product Development

Digital Product Development

IT Architectural Design

Data Scientist, A.I.

Marketing & Distribution

Regulatory Compliance