SHEP does not rely solely on asset allocation and subjective rebalancing to reduce risks in client portfolios. It:

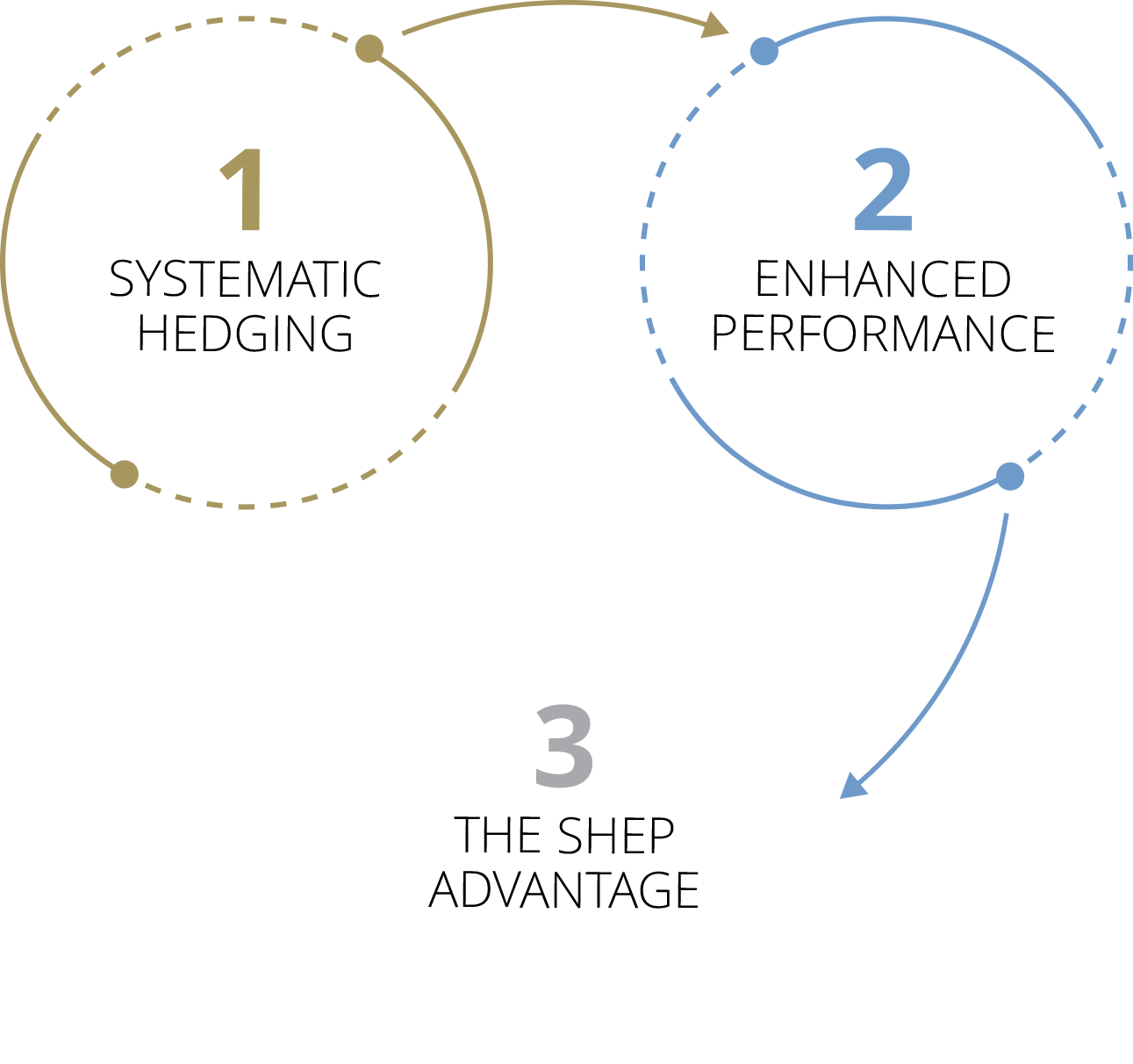

The SHEP Advantage, leading with protection, is key to delivering alpha.

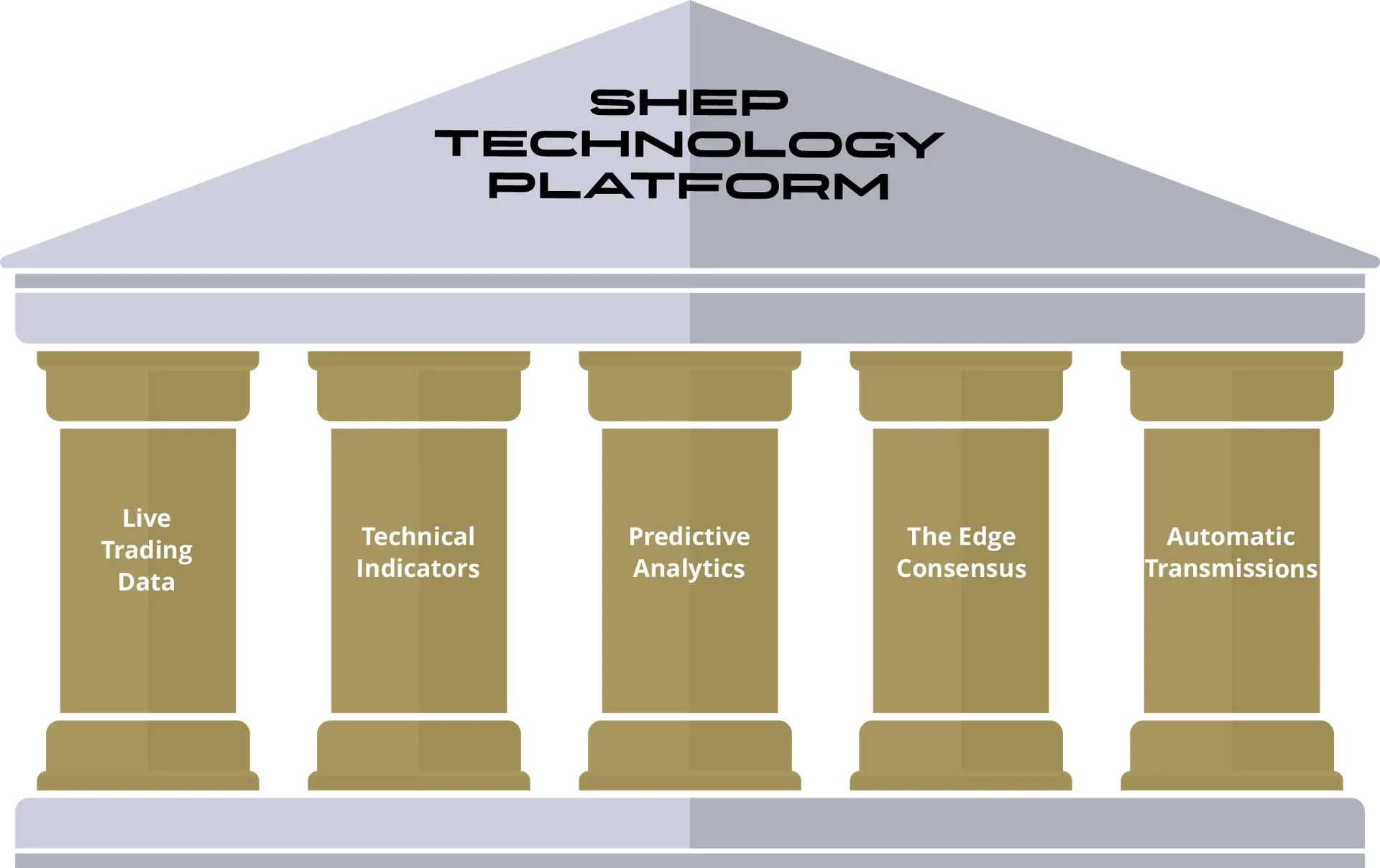

Streaming live trading data is a key enabler of the SHEP® platform’s potential for delivering timely and accurate decisioning to effectuate its rules-based protection and performance objectives.

The use of technical indicators is core to rationalizing the current and anticipated market movements, supply and demand, and other market psychological factors.

Our proprietary branch of advanced analytics that assimilates historical data, momentum factors, unique smoothing analytics, and statistical modeling while attempting to formulate predictive patterns that enable The Edge to better discern anticipated future outcomes.

Our algorithmic consensus is a culmination of 63 relational rules-based parameters and customized risk threshold metrics whose outputs produce the SHEP® Advantage.

Executing SHEP® investment strategies with accuracy and speed not only reduces the chance for manual errors, but it also avoids emotional bias and subjectivity in trading decisions, benefitting from strict adherence in each strategy’s buy and sell discipline.

Our SHEP Advantage is produced by combining our powerful SHEP technology platform with our proprietary algorithm, the SHEP Edge. Together, investors can remain confident that our automation may improve their portfolios ability to respond effectively to ever-changing market environments. With each successful risk mitigation trade cycle, starting with protecting first, and then followed by successful timely reentries, investors can benefit from compounding more and more shares over time—The SHEP Advantage.