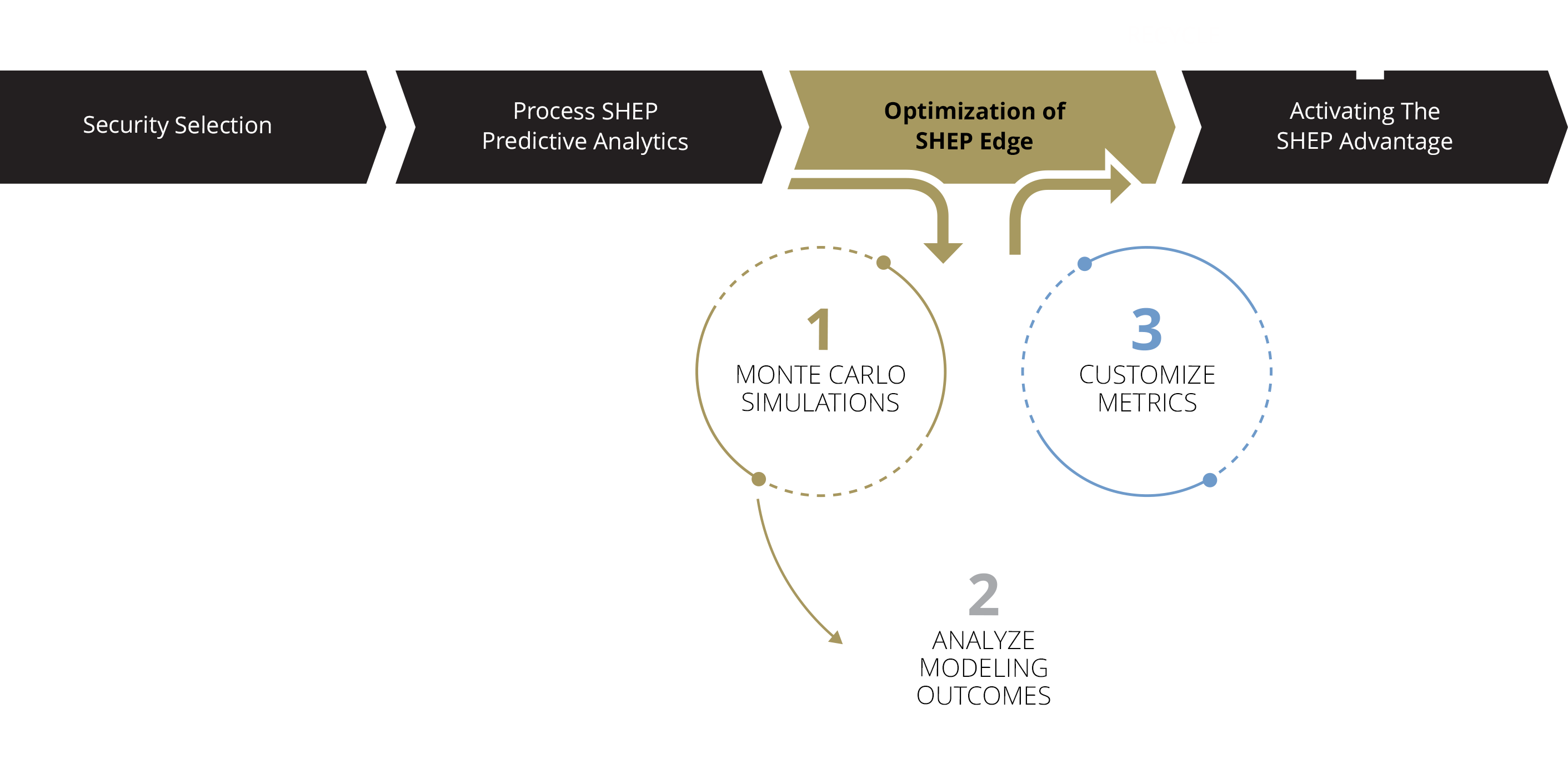

The Edge is our proprietary trading algorithm, empowered by 63 proprietary risk threshold and buy opportunity metrics, built on top of a reliable SHEP technology platform. The Edge is the key driver to all SHEP model portfolios and security investment strategies. The Edge has undergone extensive and rigorous testing as far back as 30 years across multiple securities, asset classes and investment styles. Our research and development revealed a keen ability to successfully time exit and reentry points that revealed the potential to protect in major market downturns while experiencing enhanced long-term performance.

Risk-based asset allocation constructs uniquely managed to each security’s individual optimized algorithmic metrics, resulting in more ideal tactical rebalancing

We have optimized equity strategies covering a broad range of ETFs and individual stocks, diversified by company size, investment style, and industry sectors.

Our fixed income strategies represent a wide range of core attributes necessary for diversification, including investment grade quality, sector, duration, and yield.

Alternative strategies afford our clients the ability to invest in assets that fall outside of conventional categories, optimizing commodity and cryptocurrency ETFs.

We will continue to explore how SHEP can deliver differentiated management to a variety of security types, assisting asset managers looking to boost their investment performance.

SHEP is a rules-based risk-and-reentry system that tracks market conditions, steps aside when risk rises, and gets back in by rule—no guessing, no gut feel. The aim is simple to grasp—to shrink the size and length of market drawdowns and re-enter at better prices, so over multiple cycles, our portfolios have a better chance to retain higher values in drawdowns that enable greater compounding than a pure buy-and-hold approach. The core discipline is the same for every portfolio—the same signals, the same pre-planned exits, the same structured re-entries—all executed with liquid exchange-traded ETFs and equity securities (no shorting, margin, or options).

The only choice to the investor is what is held during the “step-aside” window. Both pathways keep the discipline and transparency of the SHEP rules; they simply handle the storm differently.

Holds cash or equivalent

Stability while awaiting reentry

Holds 1X Inverse ETF

Moves oppostie core holding while awaiting for reentry

“Inverse ETFs are useful short-term tactical tools when used by sophisticated asset managers that understand risk triggers and reentry logic.” — Morningstar ETF Research Desk, 2023

What we hold in a downturn

Cash / cash-like holdings

1X Inverse ETF of the core holding

Day-to-day experience

Calmer, stable, simple to track

Similar volatility to core holding (opposite direction)

Objective in hedge window

Reduce the size/length of declines

Offset drops with gains ahead of lower buy back

Mechanics

Earn interest while waiting

No margin or shorting; inverse can rise/fall of market

Re-entry

By rule, reentering core holding

By rule, unwind hedge and reenter core holding

Who it tends to fit

Seeking steadier ride and simplicity

Bigger swings for potentially greater compounding

Key trade-off

May lag in sharp rebounds

Outcomes can amplify ups or downs

Both have SHEP Advantage

Rules-based, in pursuit of shrinking drawdowns and compounding

Same rules and aim; different tool in the hedge window; seeking more opportunistic compounding

What we hold in a downturn

Cash / cash-like holdings

1X Inverse ETF of the core holding

Day-to-day experience

Calmer, stable, simple to track

Similar volatility to core holding (opposite direction)

Objective in hedge window

Reduce the size/length of declines

Offset drops with gains ahead of lower buy back

Mechanics

Earn interest while waiting

No margin or shorting; inverse can rise/fall of market

Re-entry

By rule, reentering core holding

By rule, unwind hedge and reenter core holding

Who it tends to fit

Seeking steadier ride and simplicity

Bigger swings for potentially greater compounding

Key trade-off

May lag in sharp rebounds

Outcomes can amplify ups or downs

Both have SHEP Advantage

Rules-based, in pursuit of shrinking drawdowns and compounding

Same rules and aim; different tool in the hedge window; seeking more opportunistic compounding

Aspiring to build effective strategies is no small feat. Employing our SHEP tactical strategies, in combination with index investing, modern portfolio theory, and technical analysis all contributes to our mission of “keeping clients on the right side of the market.”

The beginning of the Modern Portfolio Theory dates back to 1952 with American economist Harry Markowitz. His position was that any given investment’s risk and return characteristics should not be viewed alone; rather, it should be analyzed by how it affects the overall portfolio’s risk and return. He discovered that by constructing portfolios using multiple asset classes that one could achieve greater returns without exposing themselves to higher levels of risk. In 1990, Dr. Harry Markowitz shared the Nobel Prize in Economics for this work.

The Modern Portfolio Theory remains the primary method in which investment portfolios are constructed today. It is foundational to how we create efficient portfolios to meet your clients’ return expectations at lower levels of risks. Yet we take it one step further, actively managing each security in client portfolios with SHEP, applying technical analysis in further pursuit of reducing risk and enhancing performance for your clients.

Technical analysis, as we know it today, was first introduced by Charles Dow and the Dow Theory in the late 1800s. Today, it has evolved to include hundreds of patterns and signals developed through years of research.

It is an investment discipline that attempts to forecast the price movement of virtually any tradable instrument that is generally subject to forces of supply and demand, including stocks, bonds, futures, and currencies. In fact, some view technical analysis as simply the study of supply and demand forces as reflected in the market price movements of a security. Professional technical analysts typically accept three general assumptions for the discipline:

Our SHEP algorithm uniquely identifies correlations between multiple momentum indicators and their respective security’s trading prices. The relationships between these two components are unique to each security in the SHEP portfolio, allowing SHEP to seek optimal returns for less risks that better protect your clients.

Goals-Based Investing (GBI) is much like it sounds. It is the development of an investment architecture specifically designed to accomplish financial goals funded within specific time frames. These constructs are generally known to rely on a combination of investments that, more specifically, minimize the probability of failing to achieve at least a minimum financial target level within a given time period.

We contend that the SHEP sell discipline, designed to anticipate and respond to market downturns by attempting to protect clients from harm, may be better positioned to accomplish their financial goals in shorter timeframes than some other conventional methods. Our defensive risk management strategy is designed to minimize downside risks. If successful, we may be able to optimize performance with significantly lower risks of shortfalls in the event of adverse market conditions.

The beginning of the Modern Portfolio Theory dates back to 1952 with American economist Harry Markowitz. His position was that any given investment’s risk and return characteristics should not be viewed alone; rather, it should be analyzed by how it affects the overall portfolio’s risk and return. He discovered that by constructing portfolios using multiple asset classes that one could achieve greater returns without exposing themselves to higher levels of risk. In 1990, Dr. Harry Markowitz shared the Nobel Prize in Economics for this work.

The Modern Portfolio Theory remains the primary method in which investment portfolios are constructed today. It is foundational to how we create efficient portfolios to meet your clients’ return expectations at lower levels of risks. Yet we take it one step further, actively managing each security in client portfolios with SHEP, applying technical analysis in further pursuit of reducing risk and enhancing performance for your clients.

Technical analysis, as we know it today, was first introduced by Charles Dow and the Dow Theory in the late 1800s. Today, it has evolved to include hundreds of patterns and signals developed through years of research.

It is an investment discipline that attempts to forecast the price movement of virtually any tradable instrument that is generally subject to forces of supply and demand, including stocks, bonds, futures, and currencies. In fact, some view technical analysis as simply the study of supply and demand forces as reflected in the market price movements of a security. Professional technical analysts typically accept three general assumptions for the discipline:

Our SHEP algorithm uniquely identifies correlations between multiple momentum indicators and their respective security’s trading prices. The relationships between these two components are unique to each security in the SHEP portfolio, allowing SHEP to seek optimal returns for less risks that better protect your clients.

Goals-Based Investing (GBI) is much like it sounds. It is the development of an investment architecture specifically designed to accomplish financial goals funded within specific time frames. These constructs are generally known to rely on a combination of investments that, more specifically, minimize the probability of failing to achieve at least a minimum financial target level within a given time period.

We contend that the SHEP sell discipline, designed to anticipate and respond to market downturns by attempting to protect clients from harm, may be better positioned to accomplish their financial goals in shorter timeframes than some other conventional methods. Our defensive risk management strategy is designed to minimize downside risks. If successful, we may be able to optimize performance with significantly lower risks of shortfalls in the event of adverse market conditions.

Answer the questions below to continue